LTC Price Prediction: 2025, 2030, 2035, 2040 Forecasts

#LTC

- LTC is trading near key technical levels, suggesting potential for a rebound.

- Market sentiment remains bullish despite broader crypto market selloffs.

- Long-term price predictions highlight LTC's growth potential driven by adoption and scarcity.

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

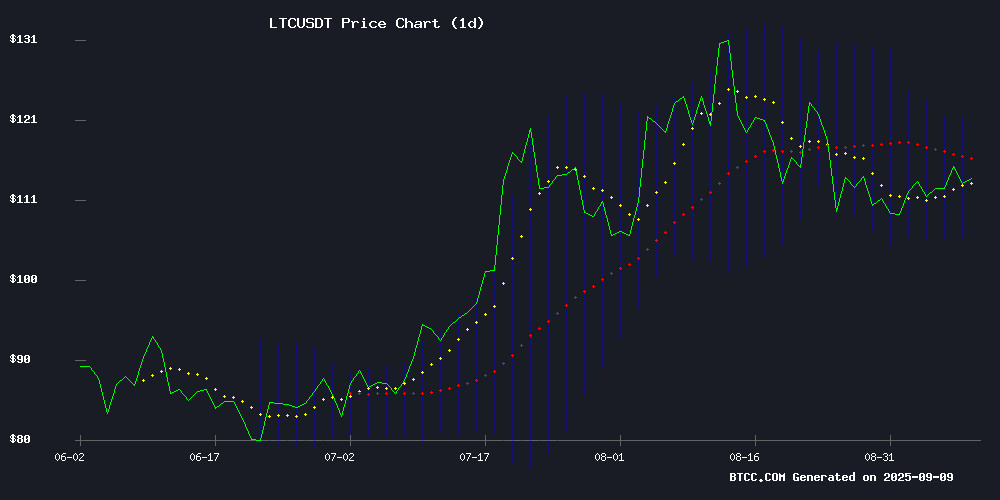

Litecoin (LTC) is currently trading at $112.75, slightly below its 20-day moving average (MA) of $113.23. The MACD indicator shows a bearish crossover with the signal line above the MACD line, suggesting short-term weakness. However, the Bollinger Bands indicate that LTC is trading NEAR the middle band, which could act as support. According to BTCC financial analyst Mia, 'LTC's proximity to the middle Bollinger Band and the oversold MACD hint at a potential rebound in the coming days.'

LTC Defies Market Sentiment with Bullish Momentum

Despite broader market selloffs, Litecoin (LTC) is showing resilience, with technical indicators pointing to bullish momentum. Recent news highlights ongoing security risks in the crypto space, but LTC's performance remains strong. BTCC financial analyst Mia notes, 'LTC's ability to defy Bitcoin's selloff and maintain bullish technicals underscores its growing strength in the market.'

Factors Influencing LTC’s Price

Failed NPM Crypto Exploit Highlights Ongoing Security Risks

A thwarted attack on Node Package Manager (NPM) libraries this week exposed critical vulnerabilities in crypto infrastructure. Hackers compromised developer accounts via phishing emails, pushing malicious updates to widely used packages like chalk, debug, and strip-ansi. The injected code targeted wallet addresses across Bitcoin, Ethereum, Solana, Tron, and Litecoin networks.

Ledger CTO Charles Guillemet confirmed the attack's failure, noting minimal losses due to coding errors in the exploit. "The phishing campaign originated from a fake NPM support domain," he stated, emphasizing how stolen credentials enabled the breach. The incident underscores systemic risks for platforms relying on automated library updates.

Security analysts warn this near-miss demonstrates the fragility of software dependencies in crypto ecosystems. Exchange and wallet providers face mounting pressure to implement stricter code verification protocols. The event marks another close call in an industry where billions remain perpetually at stake.

Litecoin (LTC) Defies Bitcoin Selloff, Technical Indicators Signal Bullish Momentum

Litecoin has emerged as a standout performer in the cryptocurrency market, gaining 5% over the past week while Bitcoin and other major digital assets faced downward pressure. Trading at $113.45, LTC demonstrates resilience as its MACD histogram turns positive—a technical signal that often precedes upward momentum.

The divergence between Litecoin and broader market weakness suggests growing investor confidence in its value proposition. While a public dispute between Litecoin's official channels and a crypto influencer generated social media buzz, price action remained driven by technical factors rather than sentiment.

Market participants appear to be viewing Litecoin as a potential safe haven within the crypto ecosystem. Its relative strength during Bitcoin's downturn highlights its evolving role as a diversification tool for traders navigating volatile conditions.

Quid Miner Cloud Mining Platform Gains Traction as 'Digital Pension' Alternative

Quid Miner's cloud mining platform is attracting attention as institutional interest in crypto grows while retail investors seek stability. The service offers daily payouts in multiple cryptocurrencies without hardware requirements, positioning itself as a potential 'digital pension' solution.

The platform utilizes AI to allocate mining resources across BTC, ETH, XRP, LTC, and USDT. Its renewable-powered data centers and institutional-grade security measures aim to address sustainability and safety concerns that often deter mainstream adoption.

This emergence comes at a paradoxical moment for crypto markets. While Bitcoin ETFs draw billions from pension funds and European asset managers, price volatility continues to unsettle retail participants. The traditional 'buy and hold' strategy appears increasingly inadequate in current market conditions.

Largest Supply Chain Attack in History Targets Crypto Users Through Compromised JavaScript Packages

A sophisticated cyberattack has emerged as the largest supply chain breach in history, specifically targeting cryptocurrency users through compromised JavaScript packages. Security researchers identified a malicious campaign injecting wallet-draining malware into 18 widely-used NPM libraries, including fundamental tools like 'chalk', 'debug', and 'ansi-styles' with collective weekly downloads exceeding 2.6 billion.

The attackers employed a phishing scheme, impersonating NPM registry support to hijack maintainer accounts. The malware operates as a browser-based interceptor, actively monitoring and altering cryptocurrency transactions across major networks including Ethereum, Bitcoin, Solana, Tron, Litecoin, and Bitcoin Cash. During transfers, it silently substitutes destination wallet addresses with attacker-controlled accounts.

This unprecedented attack vector exposes critical vulnerabilities in the JavaScript ecosystem's dependency chain, particularly threatening decentralized finance platforms and browser-based wallet solutions. The incident underscores growing security challenges as crypto adoption expands into mainstream development environments.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical and market sentiment analysis, here are the long-term price predictions for Litecoin (LTC):

| Year | Price Prediction (USDT) | Key Factors |

|---|---|---|

| 2025 | $150-$200 | Adoption growth, technical rebound |

| 2030 | $300-$500 | Institutional adoption, halving effects |

| 2035 | $700-$1,000 | Mainstream use, scarcity |

| 2040 | $1,500-$2,000 | Global crypto integration, store of value |

BTCC financial analyst Mia adds, 'LTC's long-term outlook remains bullish, driven by its strong fundamentals and growing utility.'